C45.2 million

Committed Investments

5

Self Storage Acquisitions

Investment Highlights

Padlock Partners UK Fund IV completed its initial public offering of trust units on July 12, 2023. Pursuant to the Offering, the Trust issued an aggregate of approximately C45.2 million of trust units offered to the public through a syndicate of agents led by CIBC World Markets Inc. and which included Richardson Wealth Limited, Wellington-Altus Private Wealth Inc., Canaccord Genuity Corp., National Bank Financial Inc. and Raymond James Ltd.

Strategy

The Manager established the Fund primarily for the purposes of investing in a diversified portfolio of income producing commercial real estate properties in the UK with a focus on self-storage and mixed-use properties. The Manager believes the self-storage and mixed-use market presents a compelling investment opportunity to acquire commercial properties across the United Kingdom.

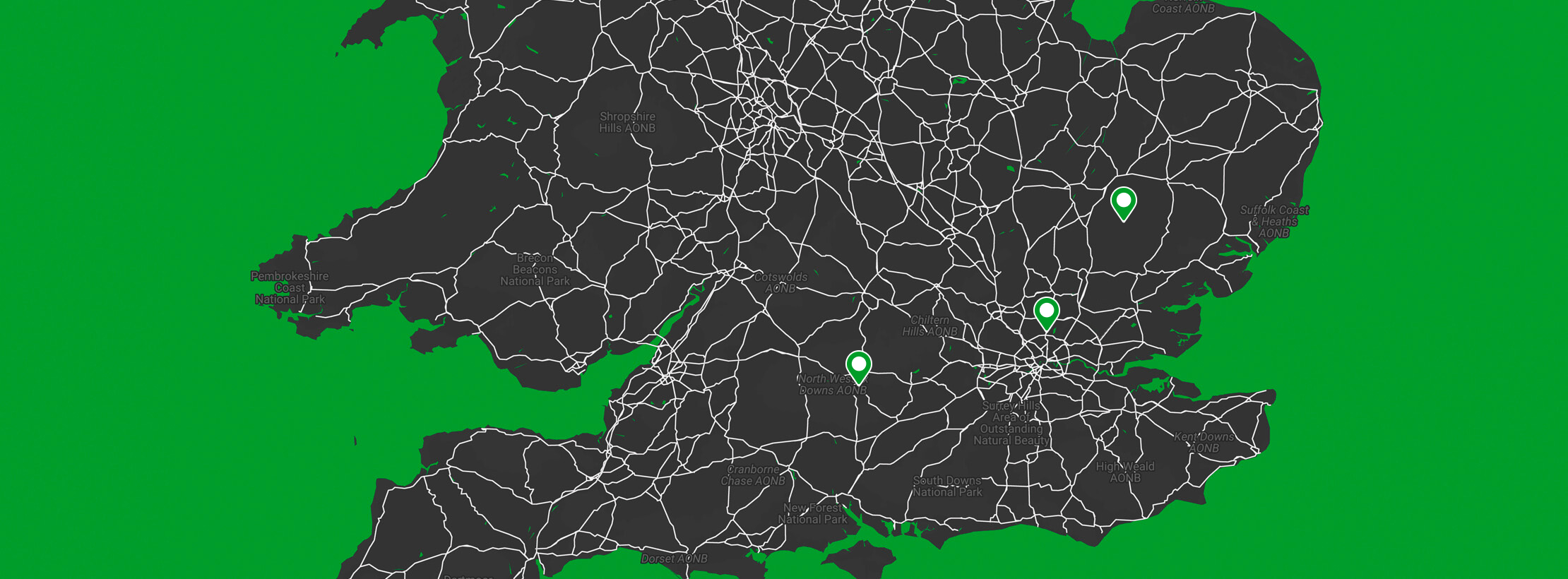

Target Markets

- Great Britain

- Major urban markets with +1M populations

- Suburban sub-markets with strong job, economic and population growth

- Strategically located

Target Assets

- Well located warehouse/mixed use conversions

- Existing value add assets

- Existing Class-A facilities

- Ground up development

Active Asset Management

- Complete substantive capital improvements to repurpose large existing warehouse/mixed use sites

- Complete light-value add capital expenditures to interiors/exteriors and amenities to attract rental premiums and increase occupancy

- Increase revenue through rental maximization

- Reduce operating expenses

- Identify ancillary revenue opportunities