C36 million

Committed Investments

4

Self Storage Acquisitions

Investment Highlights

Padlock Partners UK Fund II completed its initial public offering on June 8, 2021, issuing an aggregate of approximately C$33.8 million of trust units. The initial offering was issued through a syndicate of agents led by CIBC World Markets, Inc. and which included Richardson Wealth Limited, Wellington-Altus Private Wealth Inc., Canaccord Genuity Corp., National Bank Financial Inc. and Raymond James Ltd.

Strategy

The Manager established the Fund primarily for the purposes of investing in a diversified portfolio of income producing commercial real estate properties in the UK with a focus on self-storage and mixed-use properties. The Manager believes the self-storage and mixed-use market presents a compelling investment opportunity to acquire commercial properties across the United Kingdom.

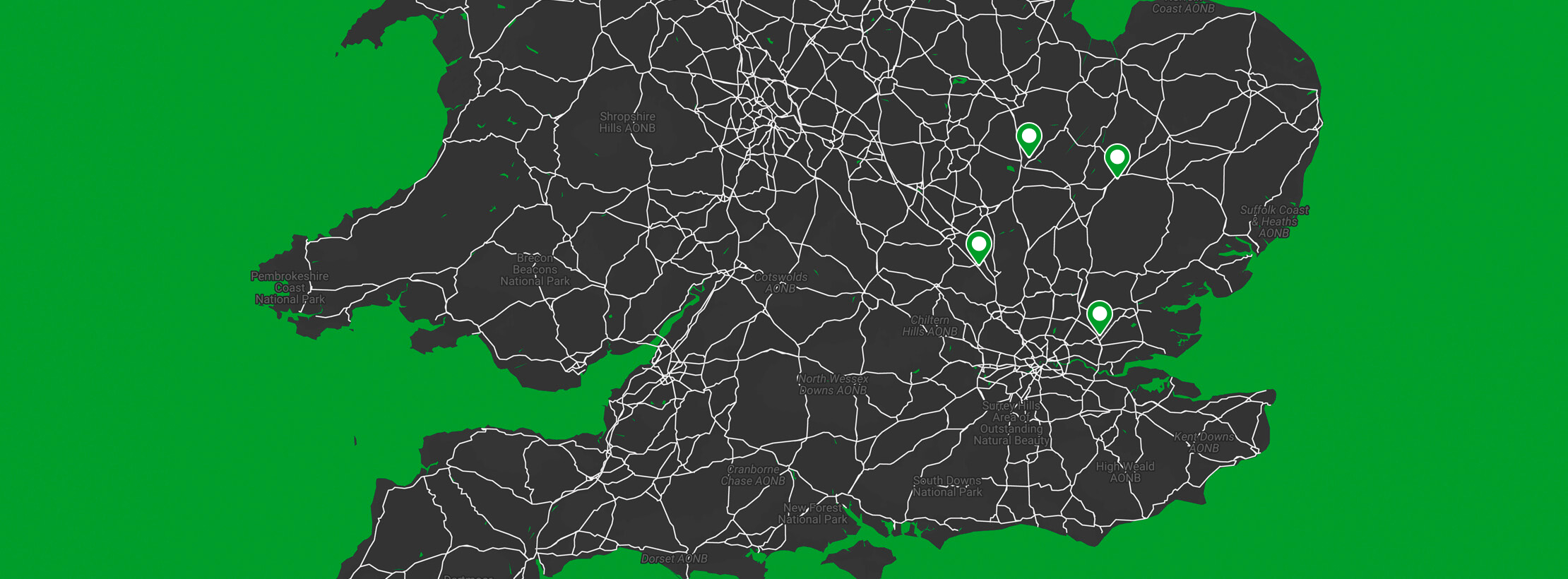

Target Markets

- Great Britain

- Major urban markets with +1M populations

- Suburban sub-markets with strong job, economic and population growth

- Strategically located

Target Assets

- Well located warehouse/mixed use conversions

- Existing value add assets

- Existing Class-A facilities

- Ground up development

Active Asset Management

- Complete substantive capital improvements to repurpose large existing warehouse/mixed use sites

- Complete light-value add capital expenditures to interiors/exteriors and amenities to attract rental premiums and increase occupancy

- Increase revenue through rental maximization

- Reduce operating expenses

- Identify ancillary revenue opportunities